Knowledge Creates

More Wealth Than Dollars

Personalized advice from experts who educate and guide, not high-pressure sell. We work with you, and never work for commission.

The Benefits of Working With Ridgewood

We help you achieve multiple streams of passive income using proactive financial strategies

and access to sophisticated public and private investments.

Expertise

Experienced, Ivy League educated, and top credentials.

Customization

Personalized portfolios for your needs, not pre-packaged.

100% Fee-Only

We work with you, and never work for commission.

Achieve Financial Freedom & Security by Working with Ridgewood

- Compound your investments

- Reduce your tax burden

- Create passive income streams

- Retire Early

Services We Provide

Customized Portfolio Management

Unlike other firms that sell off the shelf plans, our in-house team of experts builds your portfolio to your unique needs.

Access to Private Investments

Income Real Estate, Private Debt, Private Businesses, Microcap, Dividend Growth, Cryptocurrency, Venture Capital

Proactive Financial Guidance

We take the time to thoroughly analyze your needs to proactively guide you with a sophisticated multifamily office approach.

Tax Reduction Strategies

Tax deductible 401k, defined benefit retirement plans, and IRA setup and other sophisticated but often overlooked tax savings strategies.

How Does Ridgewood Investments Differ From the Competition?

We have an established record of building wealth through patience and experience. We help you achieve exceptional long-term investment performance through a principled approach that can succeed regardless of market conditions.

Ridgewood Investments

- Work with a seasoned expert

- Educate you on options, 100% fee-only

- Personalized and customized portfolios

- Investment solutions managed in-house

- Long term focus

- Proactive and responsive

- Outreach to keep you informed

- Multi-family office approach

Other Investment Firms

- Work with inexperienced recent hires

- Sell you services to earn commissions

- Pre-packaged cookie-cutter investments

- Outsourced investments and funds

- A short term approach

- Often reactive or hard to reach

- Only track what they manage

- Outreach to sell you more services

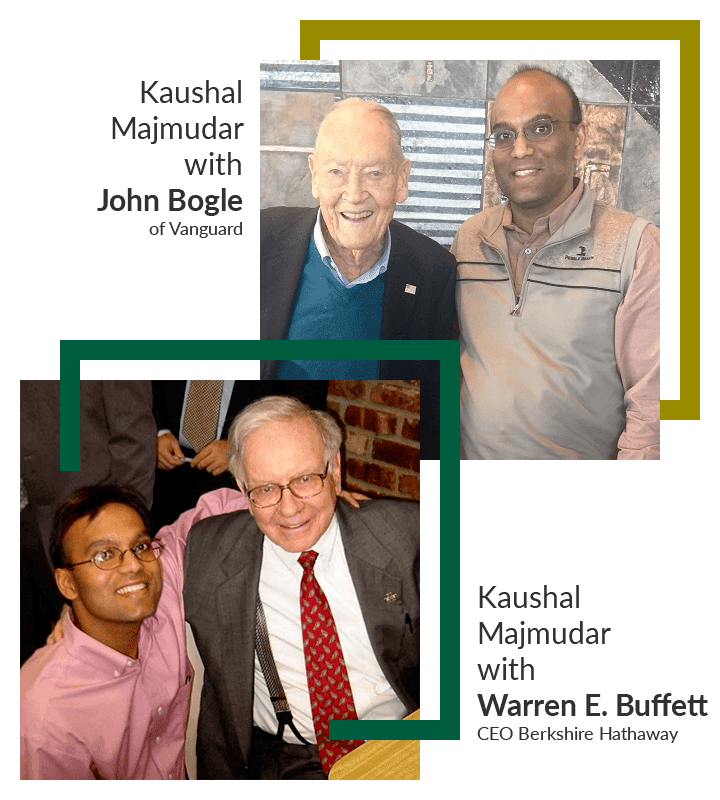

Our Founder

Kaushal “Ken” Majmudar, CFA

My family emigrated to the United States from India when I was 5 years old. From humble beginnings my new homeland afforded me great educational and career opportunities. I remain grateful for these blessings and founded Ridgewood Investments in 2002 to help our many successful clients achieve transformational results with their money.

Our approach is based on the success lessons taught by renowned investors like Warren Buffett, John Bogle, Philip Fisher, Peter Lynch and many other great investors. We guide our clients to intelligently apply these proven techniques with discipline and consistency to create life changing outcomes.

Our Strategic Partners

How to Get Started

In our review and with input from you, we will outline a personalized plan to intelligently upgrade your investments along with a proactive financial roadmap. Once you review and approve, we work with you to make the transition process as smooth as possible.

If you qualify, working with Ridgewood allows you to spend your valuable time focusing on your personal and professional priorities while knowing that our advisors are actively working to position your wealth to grow, managing risks and proactively bringing you opportunities and strategies previously limited to only the very wealthiest families.

2024 Investment Outlook: A Winning Framework for Identifying High-Growth Sectors

The investment landscape is constantly evolving, creating new opportunities for explosive growth and wealth creation in certain industries and areas that many investors have not

A Smarter Way to Manage Your Debts and Expenses

Let’s face it, managing money can be a daunting task. Especially when you’re an average middle class or working person trying to pay off debts

Why Financial Education is Critical for Your Financial Freedom

Every day, working-class Americans go to work to make ends meet. They work hard and put in long hours, but many still struggle to pay